The smart Trick of Bad Credit Financing That Nobody is Discussing

Table of ContentsBad Credit Financing Can Be Fun For AnyoneIndicators on Bad Credit Financing You Need To KnowBad Credit Financing for DummiesBad Credit Financing for Beginners6 Easy Facts About Bad Credit Financing DescribedBad Credit Financing for BeginnersThe Basic Principles Of Bad Credit Financing Little Known Facts About Bad Credit Financing.What Does Bad Credit Financing Do?Some Known Factual Statements About Bad Credit Financing

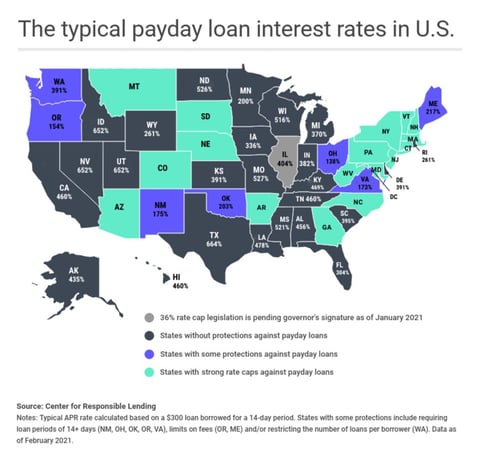

A payday lender will not always carry out a credit score contact the major credit bureaus when you look for a financing. While that might make it simpler to obtain a payday advance loan when you have negative debt, the high expense could make it hard to pay off. High-cost payday lending is banned in some states.

The Greatest Guide To Bad Credit Financing

If you're refuted credit report as a result of information in your debt reports, you must receive what's called an negative activity notification from the lender, offering you a description. This can help you understand why you were refuted and also influence you to comb through your credit rating records and see where your credit scores stands.

Here are a few financing kinds to take into consideration if you have negative debt. Some personal financing lenders provide installment financings to people with poor credit. If you qualify, you'll likely pay greater interest rates than someone with good credit rating but it'll probably still be much less than you would certainly pay with a cash advance loan.

Unknown Facts About Bad Credit Financing

A typical payday advance loan might have an APR of 400%, and the brief payment timeline typically traps consumers in a cycle of financial debt that's tough to leave. When we looked for the most effective individual fundings for bad credit rating we took into consideration factors such as convenience of the funding application process, rate of interest, costs, financing quantities offered, finance terms and lender openness.

If this seems like something you 'd be interested in finding out even more about, after that take a minute to review our evaluation of the very best installment lendings for poor credit history. Low credit score candidates approved Money in as low as 1 day Big network of lenders Registered OLA participant Top quality selection of educational resources $5,000 max finance amount Not offered in all states Established in 2010, Money, Mutual is an on the internet lending marketplace that focuses on installation lendings, individual lendings, as well as short-term cash breakthroughs - bad credit financing.

The Main Principles Of Bad Credit Financing

To make use of the solution, merely finish an application, go into the preferred loan quantity, as well as let Cash, Shared job its magic. bad credit financing. In many cases, Money, Mutual can have a finance approved and money in your account in just 1 day. What's more, the firm deals with numerous lending institutions happy to approve unsecured individual car loans for applicants with a credit score of 600 or much less.

The business is an accredited member of the Online Lenders Partnership - a company committed to safeguarding customers and outlining criteria and ideal techniques for on the internet lending institutions. To use Money, Mutual, candidates need to have a minimum monthly revenue of $800 as well as be 18 years of age or older. Some loan providers in the network even accept social protection, disability, and also other kinds of benefits as qualifying revenue - making it a terrific choice for seniors or experts.

Not known Facts About Bad Credit Financing

If you have actually located on your own knee-deep in debt card financial debt and have an OK to fair credit report, settling your credit scores via a personal funding is worthy of some serious consideration. Interested? If so, recognize that Cash money, United States refines funding applications of, making them a great candidate for the job.

$10,000 $500 5. 99% - 35. 99% (differs by lending institution and also credit history) Poor credit score financings approximately $10,000 Web Site Charge card readily available No minimum credit history requirement No minimum month-to-month earnings requirement High authorization rating Auto, residence, and pupil financings offered Rate of interest can be high on some car loans Not available in all states As the name suggests, specializes in giving bad credit history customers with rapid access to cash money when they need it most.

Examine This Report about Bad Credit Financing

One essential function that divides the attire from various other lending networks is its addition of peer-2-peer lending institutions. Peer-2-peer fundings are different from regular installment loans because they're granted by individuals, as well as not lending organizations. Due to the fact that of this, rate of interest prices on peer-2-peer loans commonly feature lower rates of interest and also greater approval prices.

Little Known Facts About Bad Credit Financing.

This implies all finances need to be repaid in one installation as well as not equal monthly payments. That said, payday advance featured a lot greater rate of interest than installment financings as well as variety from 235% to 1304%. While this is no question a drawback, they come to all lenders no matter their credit history.

Some lending institutions even provide term sizes of approximately 72 months, which depending upon the rate of interest, can leave you with affordable month-to-month repayments. Certainly, only candidates with an appropriate credit score history will certainly receive the. Still, 247Credit, Now will certainly process, which come to candidates with credit report scores as reduced as 580.

The Best Guide To Bad Credit Financing

The rates vary and also are figured out by each lender. Your funding terms rely on the type of finance you approve. Payday fundings are typically due on your following pay day. Various other loan terms range from 6 to 72 months. Of all companies providing exact same day car loans for bad credit report, an excellent section of review them are unethical and also predative - supplying passion rates as well as origination charges well-above sector criterion.

If you remain in a pinch, you do not intend to wait approximately 5 organization days for a feedback. As a result of this, all offering networks consisted of in our listing can have a car loan accepted as well as processed in as little as 24 hr! Poor credit score installation fundings will constantly feature more than average rate of interest - it's inescapable.

5 Easy Facts About Bad Credit Financing Explained

Every person's circumstance is various. While some call for simply a few hundred bucks, others may need accessibility to several thousand. With this in mind, our checklist of financing networks consists of alternatives for finances as click for source reduced as $100 and as high as $35,000. Yes, all installation lending lending institutions will run a credit scores check prior to accepting a funding.

Indicators on Bad Credit Financing You Should Know

Comparative, flexible credit report items - like bank card or credit lines - permit the consumer to make use of as a lot, or as little, of their extended credit scores as they like. Open-ended funding items have no defined repayment period, and instead, the borrower has to make a minimum of the minimal month-to-month settlement to maintain the account in great standing.